Introduction

The residential real-estate market in the Mumbai Metropolitan Region (MMR) occupies a unique position in India’s housing ecosystem. On one hand it benefits from limited land, infrastructure upgrades, and high-value demand; on the other, it faces mounting supply pipelines and price pressures that raise the question: Is oversupply becoming a material risk? This article evaluates key data, supply-demand dynamics, scenario outcomes and practical implications for homebuyers and stakeholders.

1. Key Market Data at a Glance

- In H1 2025, the MMR recorded approximately 62,890 units sold, down by about 34% year-on-year from H1 2024’s 84,465 units. The Economic Times

- Simultaneously, property registration paperwork touched a high figure: about 75,672 registrations in H1 2025, up ~4% YoY. The Economic Times

- In the first half of 2025, nearly 47,035 units in MMR were sold in the sub-₹5 crore price range, accounting for ~96% of primary-market volumes. Hindustan Times

- Meanwhile, price appreciation remains strong in certain sub-markets: for instance, in Navi Mumbai, average home values were reported to be up ~17.4 % in early 2025. Business Standard

These data points indicate a market in transition — robust high-value demand, but signs of slowing volume growth and concentration of sales in specific segments.

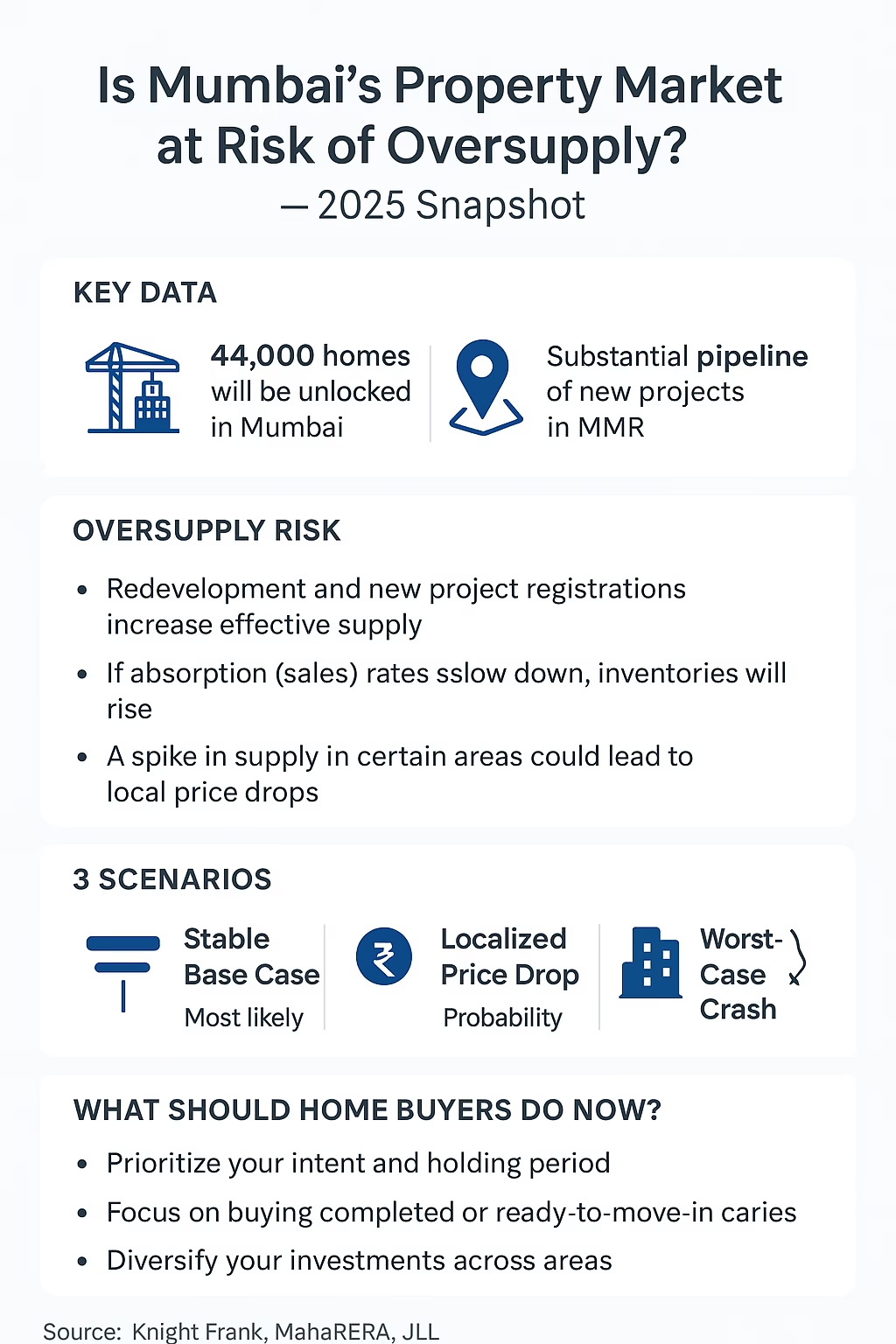

2. Supply-Demand Dynamics: Why Oversupply Could Matter

a) Rising effective supply

While land scarcity persists in core zones of Mumbai, the redevelopment cycle and launches in adjacent suburbs are unlocking large new volumes of stock. Even if launches are staggered, the pipeline matters for forward supply pressure.

b) Demand shift and segmentation

Although sales volume has dropped, the ticket size of homes sold has increased (average ticket ~₹1.60 crore in H1 2025) indicating that premium units are being absorbed while mid-segment may see weaker traction. The Economic Times+1

Segmental oversupply risk thus emerges where supply outpaces end-user demand — particularly for mid-to-upper-mid segments in suburbs.

c) Price vs. affordability

Even though price growth continues in many pockets, sustained high prices combined with rising interest rates, inflation or employment uncertainty can throttle effective demand — turning supply pressure into price correction risk.

d) Localised vs. broad-market risk

Because the MMR market is heterogeneous (core city vs suburbs vs redevelopment zones), oversupply may first manifest locally (e.g., in a given micro-market) before rippling broadly. Reports have flagged risks in south-central Mumbai luxury stock. RealtynMore

3. Three Scenarios for the Next 12-24 Months

Scenario 1 — “Stable base-case”

Most likely outcome. Demand remains modest but stable, supply addition is absorbed albeit with longer timelines, and price growth continues in prime micro-markets while mid-segments see slower growth. Little to no major correction.

Scenario 2 — “Localised correction”

In selected suburbs or mid-ticket segments where launches surge and demand is weaker, delivery pressures push developers to discount or slow launches. Some price softness or stagnation appears, while the core premium zones remain relatively resilient.

Scenario 3 — “Oversupply-triggered correction”

Though less likely, this is the most adverse scenario. Should supply ramp-up accelerate significantly, and if macro-conditions (employment, affordability, credit) weaken, then a broader market correction could emerge — with price falls, higher inventory, slower sales across multiple micro-markets.

4. Practical Implications for Homebuyers

- Focus on location and product quality. Buying in well-connected micro-markets with strong end-user demand (rather than just speculation) helps reduce risk.

- Buy for use, hold for the long term. If you intend to live in the home and hold for 5-10 years, minor price fluctuations matter less than product fit and affordability.

- Avoid over-leveraging. Be prepared for scenarios where sales slow or values stagnate; ensure your financing works even in such conditions.

- Check supply pipeline in your micro-market. High new-project launches nearby may raise competition and pressure resale values or absorption timelines.

- Clarity on purpose. If buying for investment or resale in short timeframe, understand that segmental corrections (Scenario 2 or 3) can erode returns. If buying for living, focus on utility, location, and overall financial fit.

5. Key Takeaways

- The MMR housing market remains resilient, especially in premium and well-connected zones, but the combined forces of large upcoming supply and uneven demand create real risk of localized corrections.

- A city-wide crash remains a lower-probability event today, but investors and buyers should remain vigilant about supply concentrations, affordability shifts and credit/market sentiment.

- For homebuyers, the prudent path is to prioritise usage, location, financing robustness, and time horizon — rather than chase rapid appreciation alone.

- Developers and policymakers, in turn, should factor absorption capacity, micro-market realities, and demand segmentation into project-launch strategies and regulatory planning.

References

- Housing sales in Mumbai region, Pune fell ~17% in Q3 2025. The Economic Times

- H1 2025 data: ~47,035 housing units sold in MMR; ~96% under ₹5 crore price segment. Hindustan Times

- Price growth: Navi Mumbai at ~17.4%. Business Standard

- ANAROCK-Merchandised data: average ticket size ~₹1.60 crore in H1 2025. The Economic Times

- Commentary on luxury oversupply in south-central Mumbai. RealtynMore

Disclaimer: This article provides data-driven commentary and scenario analysis. It does not constitute real-estate advice or guarantee any specific outcome. Prospective buyers and investors should undertake their own due diligence and consult qualified professionals.