📊 Investor ROI Comparison – Oberoi Realty Key Projects

Projects Covered:

- Three Sixty West

- Oberoi Garden City

- Sky City Borivali

- Eternia & Enigma

- Upcoming Thane Development (Pokhran Road)

🏆 ROI Comparison Table (Investor Perspective)

| Project | Location | Capital Appreciation CAGR (10 yrs) | Rental Yield | Total Estimated ROI (Annualised) | Investor Profile |

|---|---|---|---|---|---|

| Three Sixty West | Worli | 10–12% | 2–3% | 12–15% | Ultra HNI / Trophy Asset |

| Garden City | Goregaon | 8–10% | 2.5–3% | 10–13% | Long-term wealth + rental |

| Sky City | Borivali | 9–11% | 2.8–3.2% | 11–14% | Mid-HNI capital growth |

| Eternia/Enigma | Mulund | 7–9% | 3–3.5% | 10–12% | Balanced growth + yield |

| Thane Upcoming | Thane | 12–15% (early stage) | 2.5–3% | 13–16% (Projected) | Early investors / entry gain |

📈 Key Insights: ROI Drivers by Project

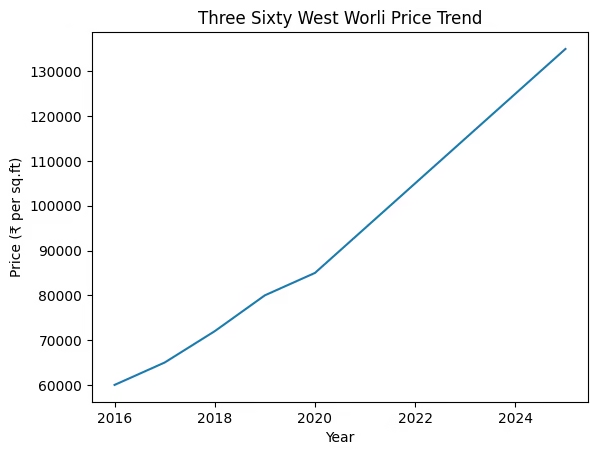

1️⃣ Three Sixty West – Trophy Asset ROI

- Prices ~₹1 lakh–₹1.5 lakh per sq ft resale range

- Ultra-luxury demand from HNIs & celebrities

- Limited inventory = strong capital growth

➡ ROI Logic:

- Capital Appreciation: ~10–12% CAGR

- Rental yield: ~2–3% typical luxury segment

- Total expected ROI: 12–15% annually

Luxury markets like Worli have seen 10–12% CAGR appreciation over a decade, driven by scarcity and global demand for prime sea-facing homes. (HomeSharp)

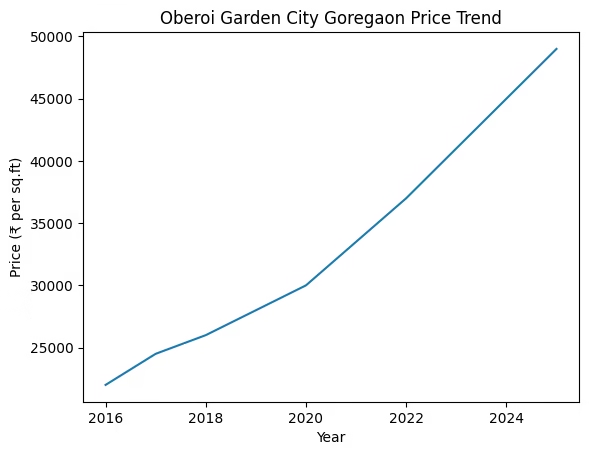

2️⃣ Oberoi Garden City – Township Wealth Builder

- Integrated township model (mall + office + residences)

- Strong resale liquidity and end-user demand

ROI Mix:

- Appreciation: 8–10% CAGR

- Rental Yield: 2.5–3%

- Total ROI: 10–13%

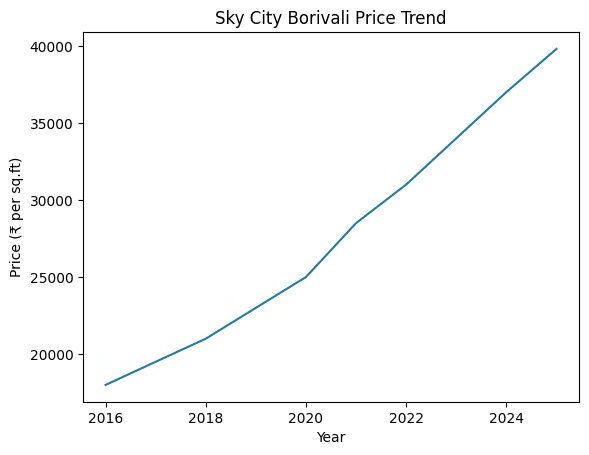

3️⃣ Sky City Borivali – High Growth Corridor

- Located in Jogeshwari–Borivali belt (highest housing sales corridor)

- Metro & infra expansion driving price rise

The Jogeshwari–Borivali corridor has recorded strong housing sales growth and rising demand in recent years. (The Times of India)

ROI Estimate:

- Appreciation: 9–11%

- Rental: ~3%

- Total ROI: 11–14%

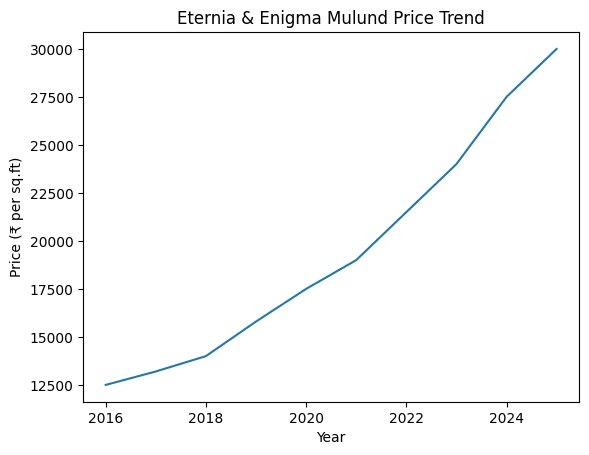

4️⃣ Eternia & Enigma – Balanced Investor Asset

- Emerging premium suburb

- End-user + rental tenant mix

ROI Outlook:

- Appreciation: 7–9%

- Rental Yield: ~3–3.5%

- Total ROI: 10–12%

5️⃣ Upcoming Thane Projects – Early Entry Advantage

- Large land bank unlocking value

- Infra push (Metro + Ghodbunder connectivity)

Expected ROI:

- Early-stage capital growth: 12–15%

- Long-term ROI: 13–16% potential

💡 Macro Investor Insight: Mumbai Luxury ROI Benchmark

- Luxury rental yields: 2–3%

- Total long-term ROI in prime micro-markets: 10–15% annually

(HomeSharp)

This aligns strongly with Oberoi Realty’s premium portfolio positioning.

🏅 Best Project by Investor Goal

| Investor Goal | Best Project |

|---|---|

| Ultra Luxury Wealth Preservation | Three Sixty West |

| Long-Term Rental + Appreciation | Garden City Goregaon |

| Capital Growth Corridor | Sky City Borivali |

| Balanced Growth + Yield | Eternia Enigma Mulund |

| Early-Stage High Upside | Upcoming Thane |

📊 Final Investor Verdict

- Highest Prestige ROI: Three Sixty West (HNIs & global investors)

- Best Long-Term Township Investment: Garden City Goregaon

- Best Growth Bet (Next 5–10 yrs): Sky City Borivali

- Stable Mid-Segment Luxury Investment: Mulund Projects

- Highest Future Upside: Thane Upcoming Developments

📌 Strategic Investment Conclusion

For diversified luxury real estate exposure in Mumbai:

✔ Core Holding: Worli ultra-luxury

✔ Growth Allocation: Borivali & Thane

✔ Stability & Rental: Goregaon Township