Weekly Index Performance (14–18 July 2025)

| Date | Open | Close | % Change |

|---|---|---|---|

| 14 Jul | 976.25 | 964.95 | –1.17% |

| 15 Jul | 983.95 | 979.70 | +0.79% |

| 16 Jul | 988.85 | 986.05 | +0.50% |

| 17 Jul | 1,001.10 | 994.15 | +1.24% |

| 18 Jul | 999.90 | 1,005.45 | +0.56% |

Total Weekly Gain: ≈ +3.84%

Stock-Wise Performance Overview

Top Performers:

- Sobha Ltd: Strongest gainer early in the week.

- Godrej Properties, Phoenix Mills, Prestige Estates, DLF, Oberoi Realty: Consistent upward movement during mid-to-late week.

Underperformers:

- Brigade Enterprises, Raymond Realty, Mahindra Lifespaces: Weak early sessions, minor late recovery.

Market Cap Impact: Sector-wide valuation rose by ∼₹30,000 crore, consistent with index trend.

Elliott Wave Recap (7–11 July 2025)

- A textbook ABC correction was confirmed:

- Wave A: Rise early week

- Wave B: Pullback midweek

- Wave C: Bounce from 970 levels on Friday

- Wave III likely initiated post 11 July, confirmed by impulsive movement above 988.

- RSI and MACD suggest strength continuation, aligning with wave progression.

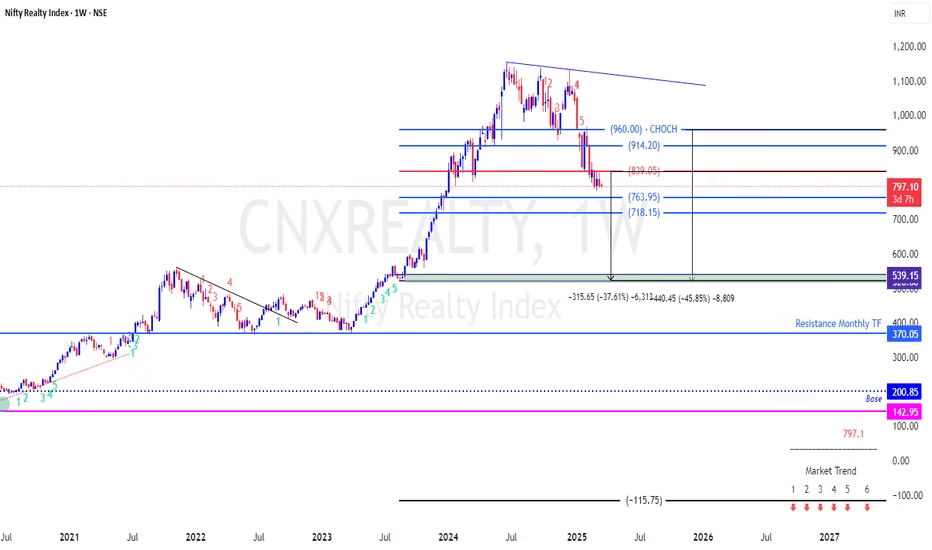

Technical Outlook (21–25 July 2025)

Bullish Scenario:

- Break and sustain above 1,005 confirms Wave III

- Resistance targets: 1,020–1,050

Bearish Scenario:

- Drop below 984–988 risks correction (Wave IV)

- Support levels at 970, 960, and 955

Indicators to Monitor:

- Volume confirmation on breakout

- RSI > 55

- MACD histogram positivity

Watchlist Stocks: Sobha, Godrej, DLF, Oberoi (leading the momentum)

Summary

- 14–18 July: Nifty Realty surged +3.8%; major gains from Sobha, Godrej, and DLF.

- Previous Elliott structure confirmed, Wave III is in motion.

- Key resistance: 1,020–1,050; maintain bullish bias above 1,005.

Stay tuned for weekly updates and technical insights tailored to sectoral momentum and wave theory applications.