📅 Date: July 14, 2025

📍 Location: Mumbai, Maharashtra

Introduction

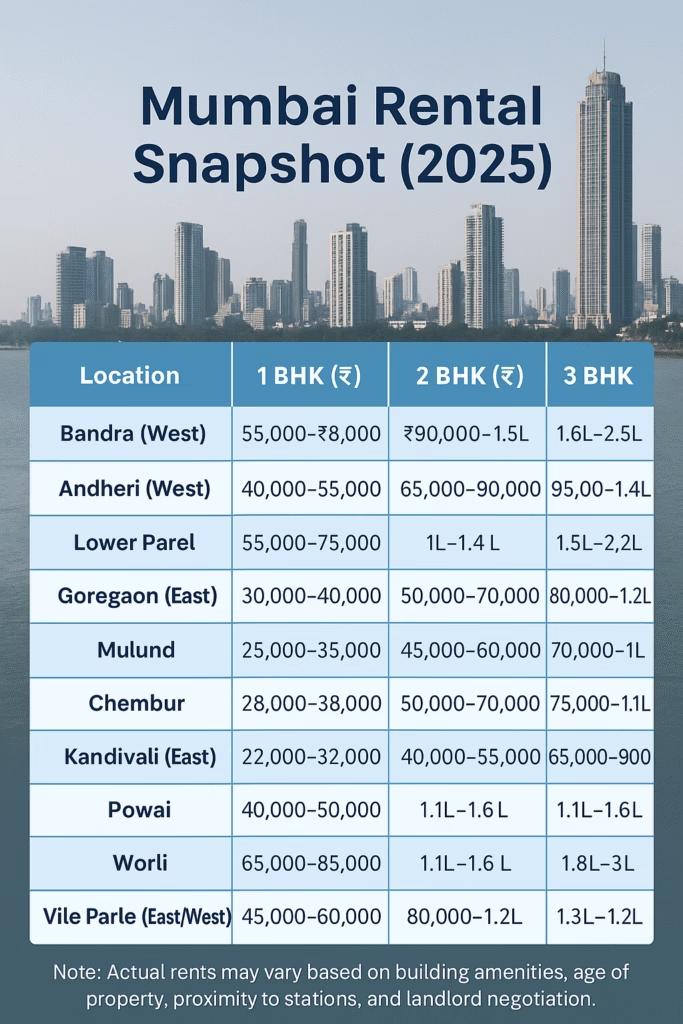

After a steep surge in rental rates over the last two years, Mumbai’s rental market is showing signs of stabilizing. The sharp increase in housing supply, coupled with a slowdown in redevelopment activity across key suburbs, has begun to cool the runaway rents that had become a challenge for both new and existing tenants in India’s financial capital.

Rental Prices: A Shift in Momentum

Until early 2024, Mumbai witnessed an extraordinary spike in rental values, especially in prime locations like Bandra, Juhu, Andheri, and Lower Parel. This surge was driven by limited availability of rental inventory due to large-scale redevelopment and delayed project completions post-pandemic.

However, in 2025, the trend has shifted. Data from multiple real estate market trackers suggests that monthly rents in Mumbai have plateaued or even declined slightly in pockets where new supply has entered the market.

Suburban Rents See More Correction

Areas such as Chembur, Mulund, Goregaon, and Kandivali—which previously saw double-digit rental growth—are now witnessing a cooling-off period. With more completed apartments hitting the market and fewer redevelopment displacements occurring, tenants have more choices and negotiating power.

Real estate experts point to the resumption of halted projects and increased launches of mid-segment housing as key factors in stabilizing the rental curve.

Redevelopment Activity Slows in Key Zones

A major contributor to the earlier surge in rents was the aggressive pace of redevelopment projects, especially in older buildings in south-central and western Mumbai. These projects led to the displacement of tenants and homeowners, flooding the rental market with temporary demand.

In 2025, however, redevelopment has slowed, largely due to increased regulatory approvals, project financing challenges, and policy uncertainties. This has reduced the forced demand for rental housing in micro-markets like Worli, Dadar, and Vile Parle.

Corporate Leasing and NRIs Shift Strategy

The slowdown in rent escalation has also influenced the behavior of corporate tenants and returning NRIs (Non-Resident Indians). Companies are no longer being forced to pay a premium to secure rental accommodations for their employees, and many expatriates are opting for more affordable long-term leases instead of short-term rentals.

This market correction is offering both domestic and international tenants more flexibility and value for money.

Forecast: Balanced Rental Growth Ahead

While Mumbai remains one of the costliest rental markets in India, experts predict more balanced and sustainable growth ahead. With a gradual rise in rental housing supply and easing of panic-driven demand, rental appreciation in 2025 is likely to stay within single-digit territory in most suburbs.

Premium locations will still command high rents, but tenant turnover is expected to slow, and landlords are more open to negotiations than in previous years.

Conclusion

Mumbai’s rental market is entering a new phase of moderation and maturity, driven by a rise in available housing and a slowdown in redevelopment disruptions. For tenants, this marks a favorable shift toward affordability and choice, while landlords must now compete on pricing, amenities, and location to attract quality tenants.