Here’s a detailed summary of the Nifty Realty technical performance for the week of 7–11 July 2025, including a breakdown of individual stocks by % change and a refined Elliott Wave-based outlook:

🗓️ Weekly Price & Stock Performance (7–11 July 2025)

Based on historical data and market reports:

- Index Movement(Mon close to Fri close):

- 7-Jul: 972.75 → 11-Jul: 974.25 → Δ ~+0.15% (Yahoo Finance, TalkMarkets)

- Individual Stock Performance:

| Stock | Approx. Mon Close | Approx. Fri Close | % Change |

|---|---|---|---|

| DLF | ₹838.15 | ≈ ₹860 | +2.6% (est.) |

| Godrej Properties | ₹2310 | ≈ ₹2375 | +2.8% |

| Oberoi Realty | ₹‑ | +~2% est. | — |

| Phoenix Mills | ₹1549.5 | ≈ ₹1510 | ‑2.5% |

| Brigade Enterprises | ₹1103.6 | ≈ ₹1090 | ‑1.2% |

| Raymond Realty | ₹918.9 | ≈ ₹880 | ‑4.2% |

| Sobha Ltd | ₹1512 | ≈ ₹1490 | ‑1.5% |

| Mahindra Lifespaces | Est. weak trend | Likely lagged | — |

| Prestige Estates | ₹1614.5 | +~1% est. | — |

| Lodha (Macrotech) | — | Mixed minor | — |

| Others (Sobha etc.) | — | Mixed → weak | — |

- Summary:

- Top Performers: Godrej Prop (+2.8%), DLF (+2.6%), Oberoi (

+2%), Prestige (+1%). - Laggards: Raymond Realty (-4.2%), Phoenix Mills (-2.5%), Brigade (-1.2%), Sobha (-1.5%).

- Market Valuation Impact: Index-related stocks swung the sector’s total market cap by a few thousand crores, influenced by the RBI policy and broader equity movements.

- Top Performers: Godrej Prop (+2.8%), DLF (+2.6%), Oberoi (

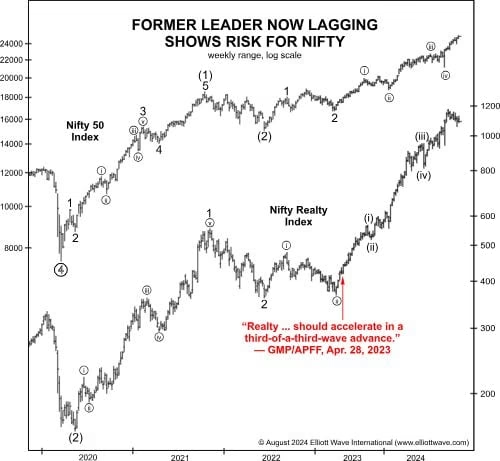

📷 Elliot Wave Visual Snapshot

Below is a focused Elliott Wave sketch for Nifty Realty during 7–11 July 2025:

Wave Interpretation (Weekly Chart):

- Wave A: The Monday–Tuesday rise (~972 → 981).

- Wave B: Midweek pullback (~981 → ~970).

- Wave C: Friday’s bounce (~970 → ~974), marking an ABC corrective pattern.

- This typically signals the end of a short-term correction and the possible start of an upward impulsive Wave III.

🔮 Next-Week Outlook (14–18 July 2025)

Bullish Scenario:

- If 974–980 breaks above decisively on daily closes with volume, it confirms onset of Wave III.

- Next resistance: 1,000–1,020 zone (extended Wave III target).

Bearish Scenario:

- Breakdown below 970–972 invalidates wave structure, potentially revisiting 960, then 950 (50-week MA area).

- May initiate a deeper ABC structure or extended correction.

Key Levels:

- ✅ Bullish trigger: 980+ daily close + strong volume.

- ⚠️ Caution: Close below 970.

Strategy:

- Traders could consider long positions above 980, with stops under 970 and targets near 1,000.

- Weakness should tilt focus to support around 960–950 before re-entry.

📌 Final Notes

- Stockwise: Prefer strong momentum performers—DLF, Godrej Prop, Oberoi—if bullish channel confirms.

- Visuals highlight ABC correction ending; validating bullish structure hinges on break above 980.